Mid-Year Market Update for 2024: What Buyers and Sellers Need to Know

Last December, when the Federal Reserve projected a series of benchmark rate cuts in the coming year, some analysts speculated that mortgage rates—which had recently peaked near 8%—would fall closer to 6% by mid-2024.1,2,3 Unfortunately, persistent inflation has delayed the central bank’s timeline and kept the average 30-year mortgage rate hovering around 7% so far this year.2

While elevated mortgage rates have continued to dampen the pace of home sales and affordability, there have been some positive developments for frustrated homebuyers. Nationwide, the inventory shortage is starting to ease, and an uptick in starter homes coming on the market has helped to slow the median home price growth rate, presenting some relief to cash-strapped buyers.4

There are also signs that sellers are adjusting to the higher rate environment, as a growing number list their properties for sale.4 Still, economists say a persistent housing deficit—combined with tighter lending standards and historically high levels of home equity—will help keep the market stable.5

What does that mean for you? Read on for our take on this year’s most important real estate news and get a sneak peek into what analysts predict is around the corner for 2024.

MORTGAGE RATE CUTS WILL TAKE LONGER THAN EXPECTED

At its most recent meeting on May 1, the Federal Reserve announced that it would keep its overnight rate at a 23-year high in response to the latest, still-elevated inflation numbers.6

While mortgage rates aren’t directly tied to the federal funds rate, they do tend to move in tandem. So, while expected, the Fed’s announcement was further proof that a meaningful decline in mortgage rates—and a subsequent real estate market rebound—is farther off than many experts predicted.

“The housing market has always been interest rate sensitive. When rates go up, we tend to see less activity,” explained Realtor.com chief economist Danielle Hale in a recent article. “The housing market is even more rate sensitive now because many people are locked into low mortgage rates and because first-time buyers are really stretched by high prices and borrowing costs.”7

Many experts now speculate that the first benchmark rate cut will come no sooner than September, so homebuyers hoping for a cheaper mortgage will have to remain patient.

“We’re not likely to see mortgage rates decline significantly until after the Fed makes its first cut; and the longer it takes for that to happen, the less likely it is that we’ll see rates much below 6.5% by the end of the year,” predicted Rick Sharga, CEO at CJ Patrick Company, in a May interview.8What does it mean for you? Mortgage rates aren’t expected to fall significantly any time soon, but that doesn’t necessarily mean you should wait to buy a home. A drop in rates could lead to a spike in home prices if pent-up demand sends a flood of homebuyers back into the market. Reach out to schedule a free consultation so we can help you chart the best course for your home purchase or sale.

BUYERS ARE GAINING OPTIONS AS SELLERS RETURN TO THE MARKET

There is a silver lining for buyers who have struggled to find the right property: More Americans are sticking a for-sale in their yard.9 Given the record-low inventory levels of the past few years, this presents an opportunity for buyers to find a place they love—and potentially score a better deal.

In 2023, inventory remained scarce as homeowners who felt beholden to their existing mortgage rates delayed their plans to sell. However, a recent survey by Realtor.com shows that a growing number of those owners are ready to jump in off the sidelines.10

While the majority of potential sellers still report feeling “locked in” by their current mortgage, the share has declined slightly (79% now versus 82% in 2023). Additionally, nearly one-third of those “locked-in” owners say they need to sell soon for personal reasons, and the vast majority (86%) report that they’ve already been thinking about selling for more than a year.10

Renewed optimism may also be playing a part. “Both our ‘good time to buy’ and ‘good time to sell’ measures continued their slow upward drift this month,” noted Fannie Mae Chief Economist Doug Duncan in an April statement.11

However, the current stock of available homes still falls short of pre-pandemic levels, according to economists at Realtor.com. “For the first four months of this year, the inventory of homes actively for sale was at its highest level since 2020. However, while inventory this April is much improved compared with the previous three years, it is still down 35.9% compared with typical 2017 to 2019 levels.”4\

What does it mean for you? If you’ve had trouble finding a home in the past, you may want to take another look. An increase in inventory, coupled with relatively low buyer competition, could make this an ideal time to make a move. Reach out if you’re ready to search for your next home.

If you’re hoping to sell this year, you may also want to act now. If inventory levels grow, it will become more challenging for your home to stand out. We can craft a plan to maximize your profits, starting with a professional assessment of your home’s current market value. Contact us to schedule a free consultation.

HOME PRICES ARE RISING AT A MORE MANAGEABLE PACE

Homebuyers struggling with high borrowing costs have something else to celebrate. The national median home price has remained relatively stable over the past year, due to sellers bringing a greater share of smaller, more affordable homes to the market.4

In addition to offering cheaper homes, a recent survey found that home sellers are also adjusting their expectations when it comes to pricing. In many regions, just 12% anticipate a bidding war (down from 23% last year) and only 15% expect to sell above list price (versus 31% in 2023).10

But buyers shouldn’t expect a fire sale. According to Realtor.com’s April Housing Market Trends Report, “On an adjusted per-square-foot basis, the median list price grew by 3.8%, as homes continue to retain their value despite increased inventory compared with last year.”4

Dr. Selma Hepp, chief economist for the data firm CoreLogic, projects that home prices will keep rising at a gradual pace through the rest of 2024. “Spring home price gains are already off to a strong start despite continued mortgage rate volatility. That said, more inventory finally coming to market will likely translate to more options for buyers and fewer bidding wars, which typically keeps outsized price growth in check.”12

What does it mean for you? An increase in more affordable housing stock is great news, especially for first-time buyers. And with home values expected to keep rising, an investment in real estate could help you build wealth over time. Reach out to discuss your goals and budget, and we can help you decide if you’re ready to take your first step on the property ladder.

DESIRE TO OWN PERSISTS, BUT AFFORDABILITY REMAINS AN OBSTACLE

Surveys show that the American dream of homeownership is alive and well, despite the financial challenges. In fact, a recent poll by Realtor.com found that 55% of Millennial and 40% of Gen Z respondents believe that now is a good time to buy a home.13

According to Fannie Mae Chief Economist Doug Duncan, buyers are starting to adapt to the new economic reality. “With the historically low rates of the pandemic era now firmly behind us, some households appear to be moving past the hurdle of last year’s sharp jump in rates, an adjustment that we think could help further thaw the housing market. We noted in our latest monthly forecast that we expect to see a gradual increase in home listings and sales transactions in the coming year.”

The Realtor.com study also revealed that even a small drop in mortgage rates could give a big boost to homebuyer demand and affordability. In fact, 40% of the buyers polled would find a home purchase attainable if rates fall under 6%, and an additional 32% plan to enter the market if rates dip below 5%.13

But waiting for rates to drop isn’t the only approach that Americans are using to afford a home. A survey by U.S. News & World Report found that determined homebuyers are employing a variety of strategies, including shopping multiple lenders (52%), purchasing discount points to lower their rates (36%), and opting for adjustable-rate mortgages (36%). More than three-quarters of today’s buyers also hope to refinance to a lower rate in the future.14

Despite the obstacles, these respondents remain steadfast in their desire to own a home, listing financial benefits, stability, and more space as their top motivations for wanting to buy.14

What does it mean for you? If you’re dreaming of a new home, let’s talk. We can help you evaluate your options and connect you with a mortgage professional to discuss strategies you can use to make your monthly payments more affordable. And remember, in many cases, you can refinance if rates drop in the future.

If you have plans to sell, it will be crucial to enlist the help of a skilled agent who knows how to maximize your profit margins and draw in qualified buyers. Reach out for a copy of our multi-step Property Marketing Plan.

I AM HERE TO GUIDE YOU

While national housing reports can give you a “big picture” outlook, much of real estate is local. And as a local market expert, I know what’s most likely to impact sales and drive home values in your particular neighborhood. As a trusted partner in your real estate journey, I can guide you through the market’s twists and turns.

If you’re considering buying or selling a home in 2024, contact us now to schedule a free consultation. Let’s work together and craft an action plan to meet your real estate goals.

The above references an opinion and is for informational purposes only. It is not intended to be financial, legal, or tax advice. Consult the appropriate for advice regarding your individual needs.

Sources:

- CBS News – https://www.cbsnews.com/news/federal-reserve-rate-decision-pause-december-13/

- Bankrate – https://www.bankrate.com/mortgages/historical-mortgage-rates/

- Fannie Mae – https://www.fanniemae.com/media/50096/display

- Realtor.com – https://www.realtor.com/research/april-2024-data/

- Bankrate – https://www.bankrate.com/real-estate/is-the-housing-market-about-to-crash/

- NPR – https://www.npr.org/2024/05/01/1248454950/federal-reserve-inflation-interest-rates

- Realtor.com – https://www.realtor.com/news/trends/will-the-fed-cut-interest-rates-2024-housing-market/

- The Mortgage Reports – https://themortgagereports.com/32667/mortgage-rates-forecast-fha-va-usda-conventional

- Fast Company – https://www.fastcompany.com/91106568/housing-market-inventory-rising-across-country-maps

- Realtor.com – https://www.realtor.com/research/2023-q1-sellers-survey-btts/

- Fannie Mae – https://www.fanniemae.com/research-and-insights/surveys-indices/national-housing-survey

- CoreLogic – https://www.corelogic.com/press-releases/corelogic-us-annual-home-price-growth-slows-still-up-by-over-5-february/

- Realtor.com – https://www.realtor.com/research/america-dream-survey-feb-2024/

- US News & World Report – https://money.usnews.com/loans/mortgages/articles/2024-homebuyer-survey

East Texas: What’s Really Happening with Mortgage Rates?

Mortgage rates don’t move in a straight line. There are too many factors at play for that to happen. Instead, rates bounce around because they’re impacted by things like economic conditions, decisions from the Federal Reserve, and so much more. That means they might be up one day and down the next depending on what’s going on in the economy and the world as a whole.

Why Pre-Approval Is Even More Important This Year

On the road to becoming a homeowner? If so, you may have heard the term pre-approval get tossed around. Let’s break down what it is and why it’s important if you’re looking to buy a home in 2024.

What Pre-Approval Is

As part of the homebuying process, your lender will look at your finances to figure out what they’re willing to loan you. According to Investopedia, this includes things like your W-2, tax returns, credit score, bank statements, and more.

From there, they’ll give you a pre-approval letter to help you understand how much money you can borrow. Freddie Mac explains it like this:

“A pre-approval is an indication from your lender that they are willing to lend you a certain amount of money to buy your future home. . . . Keep in mind that the loan amount in the pre-approval letter is the lender’s maximum offer. Ultimately, you should only borrow an amount you are comfortable repaying.”

Now, that last piece is especially important. While home affordability is getting better, it’s still tight. So, getting a good idea of what you can borrow can help you really wrap your head around the financial side of things. It doesn’t mean you should borrow the full amount. It just tells you what you can borrow from that lender.

This sets you up to make an informed decision about your numbers. That way you’re able to tailor your home search to what you’re actually comfortable with budget-wise and can act fast when you find a home you love.

Why Pre-Approval Is So Important in 2024

If you want to buy a home this year, there’s another reason you’re going to want to be sure you’re working with a trusted lender to make this a priority.

While more homes are being listed for sale, the overall number of available homes is still below the norm. At the same time, the recent downward trend in mortgage rates compared to last year is bringing more buyers back into the market. That imbalance of more demand than supply creates a bit of a tug-of-war for you.

It means you’ll likely find you have more competition from other buyers as more and more people who were sitting on the sidelines when mortgage rates were higher decide to jump back in. But pre-approval can help with that too.

Pre-approval shows sellers you mean business because you’ve already undergone a credit and financial check. As Greg McBride, Chief Financial Analyst at Bankrate, says:

“Preapproval carries more weight because it means lenders have actually done more than a cursory review of your credit and your finances, but have instead reviewed your pay stubs, tax returns and bank statements. A preapproval means you’ve cleared the hurdles necessary to be approved for a mortgage up to a certain dollar amount.”

Sellers love that because that makes it more likely the sale will move forward without unexpected delays or issues. And if you may be competing with another buyer to land your dream home, why wouldn’t you do this to help stack the deck in your favor?

Bottom Line

If you’re looking to buy a home in 2024, know that getting pre-approved is going to be a key piece of the puzzle. With lower mortgage rates bringing more buyers back into the market, this can help you make a strong offer that stands out from the crowd.

2 Factors That Impact Mortgage Rates

If you’re looking to buy a home, you’ve probably been paying close attention to mortgage rates. Over the last couple of years, they hit record lows, rose dramatically, and are now dropping back down a bit. Ever wonder why?

The answer is complicated because there’s a lot that can influence mortgage rates. Here are just a few of the most impactful factors at play.

Inflation and the Federal Reserve

The Federal Reserve (Fed) doesn’t directly determine mortgage rates. But the Fed does move the Federal Funds Rate up or down in response to what’s happening with inflation, the economy, employment rates, and more. As that happens, mortgage rates tend to respond. Business Insider explains:

“The Federal Reserve slows inflation by raising the federal funds rate, which can indirectly impact mortgages. High inflation and investor expectations of more Fed rate hikes can push mortgage rates up. If investors believe the Fed may cut rates and inflation is decelerating, mortgage rates will typically trend down.”

Over the last couple of years, the Fed raised the Federal Fund Rate to try to fight inflation and, as that happened, mortgage rates jumped up, too. Fortunately, the expert outlook for inflation and mortgage rates is that both should become more favorable over the course of the year. As Danielle Hale, Chief Economist at Realtor.com, says:

“[M]ortgage rates will continue to ease in 2024 as inflation improves . . .”

There’s even talk the Fed may actually cut the Fed Funds Rate this year because inflation is cooling, even though it’s not yet back to their ideal target.

The 10-Year Treasury Yield

Additionally, mortgage companies look at the 10-Year Treasury Yield to decide how much interest to charge on home loans. If the yield goes up, mortgage rates usually go up, too. The opposite is also true. According to Investopedia:

“One frequently used government bond benchmark to which mortgage lenders often peg their interest rates is the 10-year Treasury bond yield.”

Historically, the spread between the 10-Year Treasury Yield and the 30-year fixed mortgage rate has been fairly consistent, but that’s not the case recently. That means, there’s room for mortgage rates to come down. So, keeping an eye on which way the treasury yield is trending can give experts an idea of where mortgage rates may head next.

Bottom Line

With the Fed meeting later this week, experts in the industry will be keeping a close watch to see what they decide and what impact it’ll have on the economy. To navigate any mortgage rate changes and their impact on your moving plans, it’s best to have a team of professionals on your side.

Thinking About Buying a Home?

If you’re thinking of buying a home this year, you’re probably paying closer attention than normal to the housing market. And you’re getting your information from a variety of channels: the news, social media, your real estate agent, conversations with friends and loved ones, the list goes on and on. Most likely, home prices and mortgage rates are coming up a lot.

Here are the top two questions you need to ask yourself as you make your decision, including the data that helps cut through the noise.

1. Where Do I Think Home Prices Are Heading?

One reliable place you can turn to for information on home price forecasts is the Home Price Expectations Survey from Fannie Mae – a survey of over one hundred economists, real estate experts, and investment and market strategists.

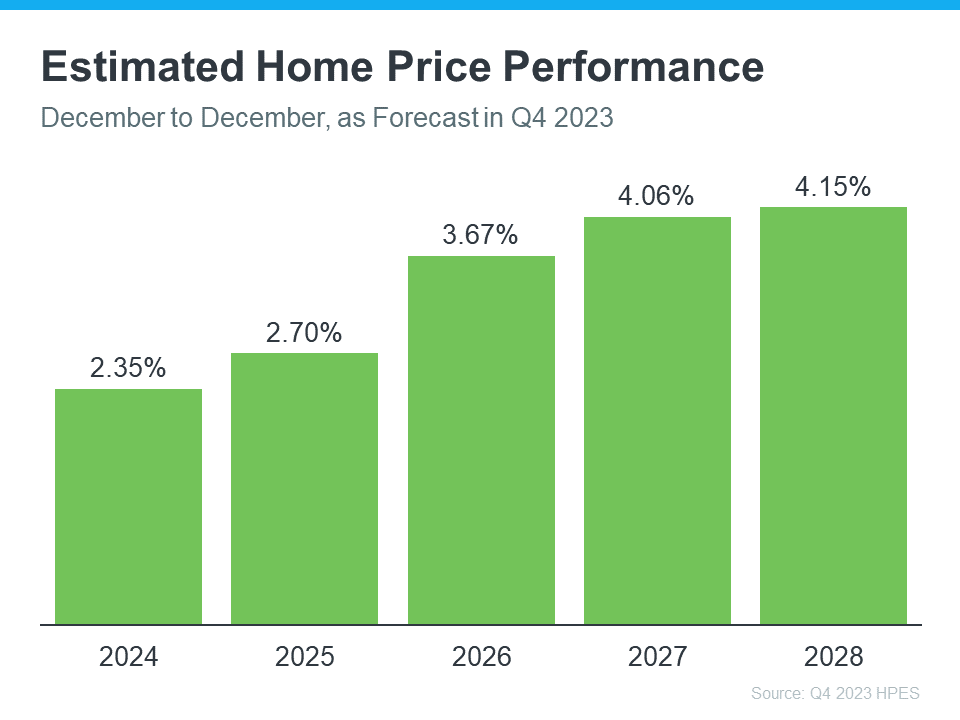

According to the most recent release, the experts are projecting home prices will continue to rise at least through 2028 (see the graph below):

So, why does this matter to you? While the percent of appreciation may not be as high as it was in recent years, what’s important to focus on is that this survey says we’ll see prices rise, not fall, for at least the next 5 years.

And home prices rising, even at a more moderate pace, is good news not just for the market, but for you too. It means, by buying now, your home will likely grow in value, and you should gain home equity in the years ahead. But, if you wait, based on these forecasts, the home will only cost you more later on.

2. Where Do I Think Mortgage Rates Are Heading?

Over the past year, mortgage rates spiked up in response to economic uncertainty, inflation, and more. But there’s an encouraging sign for the market and mortgage rates. Inflation is moderating, and here’s why this is such a big deal if you’re looking to buy a home.

When inflation cools, mortgage rates generally fall in response. That’s exactly what we’ve seen in recent weeks. And, now that the Federal Reserve has signaled they’re pausing their Federal Funds Rate increases and may even cut rates in 2024, experts are even more confident we’ll see mortgage rates come down.

Danielle Hale, Chief Economist at Realtor.com, explains:

“. . . mortgage rates will continue to ease in 2024 as inflation improves and Fed rate cuts get closer. . . . a key factor in starting to provide affordability relief to homebuyers.”

As an article from the National Association of Realtors (NAR) says:

“Mortgage rates likely have peaked and are now falling from their recent high of nearly 8%. . . . This likely will improve housing affordability and entice more home buyers to return to the market . . .”

No one can say with absolute certainty where mortgage rates will go from here. But the recent decline and the latest decision from the Federal Reserve to stop their rate increases, signals there’s hope on the horizon. While we may see some volatility here and there, affordability should improve as rates continue to ease.

Bottom Line

If you’re thinking about buying a home, you need to know what’s expected with home prices and mortgage rates. While no one can say for certain where they’ll go, making sure you have the latest information can help you make an informed decision. Let’s connect so you can stay up to date on what’s happening and why this is such good news for you.

What Past Recessions Tell Us About the Housing Market

It doesn’t matter if you’re someone who closely follows the economy or not, chances are you’ve heard whispers of an upcoming recession. Economic conditions are determined by a broad range of factors, so rather than explaining them each in depth, let’s lean on the experts and what history tells us to see what could lie ahead. As Greg McBride, Chief Financial Analyst at Bankrate, says:

“Two-in-three economists are forecasting a recession in 2023 . . .”

As talk about a potential recession grows, you may be wondering what a recession could mean for the housing market. Here’s a look at the historical data to show what happened in real estate during previous recessions to help prove why you shouldn’t be afraid of what a recession could mean for the housing market today.

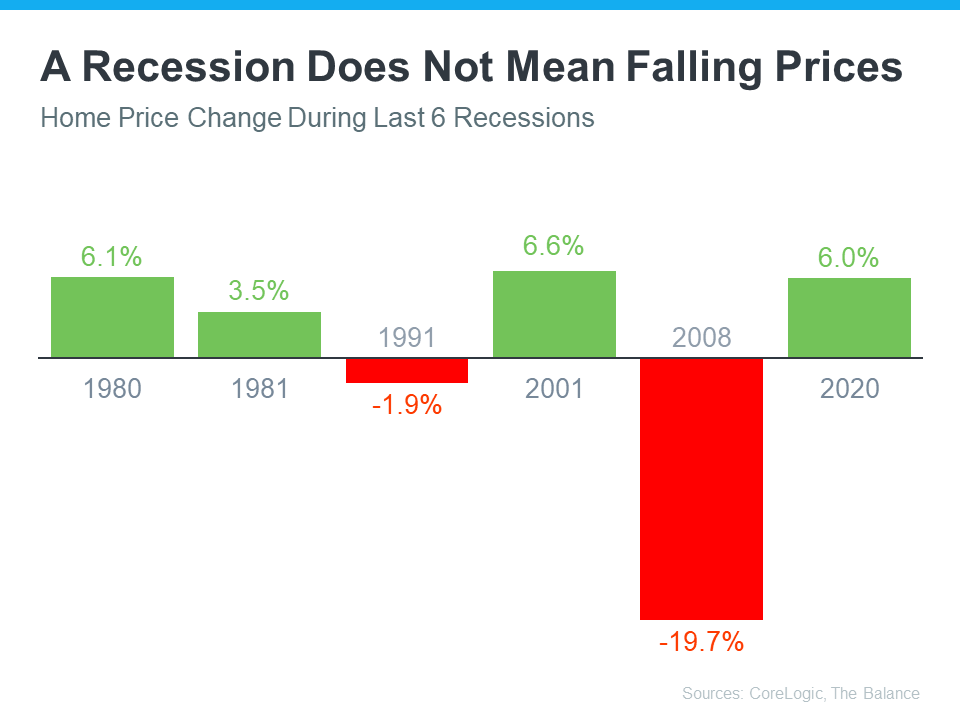

A Recession Doesn’t Mean Falling Home Prices

To show that home prices don’t fall every time there’s a recession, it helps to turn to historical data. As the graph below illustrates, looking at recessions going all the way back to 1980, home prices appreciated in four of the last six of them. So historically, when the economy slows down, it doesn’t mean home values will always fall.

Most people remember the housing crisis in 2008 (the larger of the two red bars in the graph above) and think another recession would be a repeat of what happened to housing then. But today’s housing market isn’t about to crash because the fundamentals of the market are different than they were in 2008. According to experts, home prices will vary by market and may go up or down depending on the local area. But the average of their 2023 forecasts shows prices will net neutral nationwide, not fall drastically like they did in 2008.

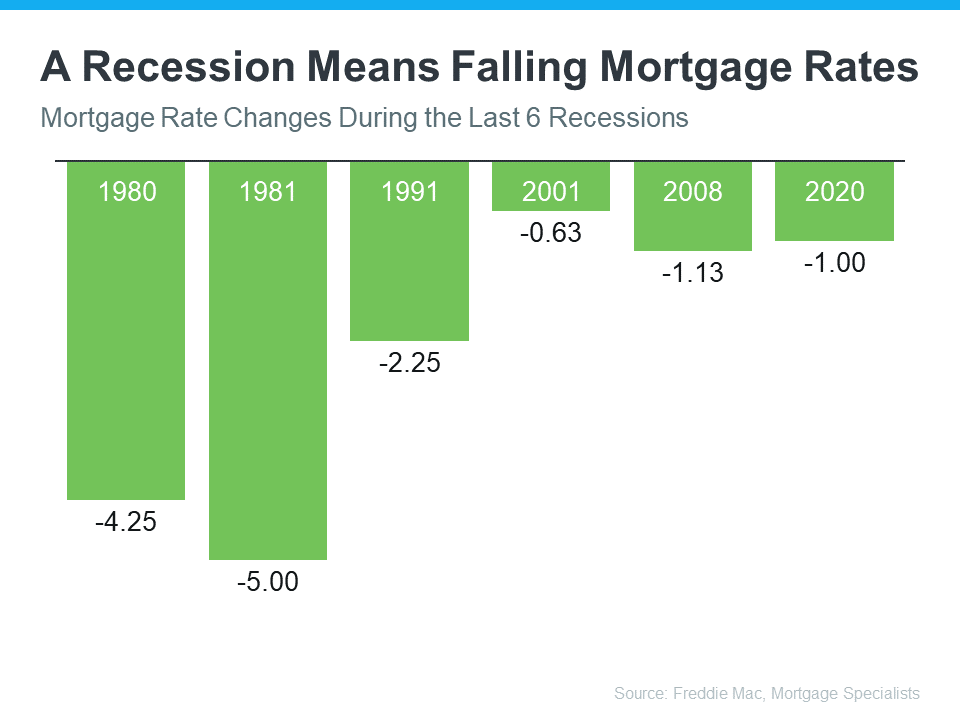

A Recession Means Falling Mortgage Rates

Research also helps paint the picture of how a recession could impact the cost of financing a home. As the graph below shows, historically, each time the economy slowed down, mortgage rates decreased.

Fortune explains mortgage rates typically fall during an economic slowdown:

“Over the past five recessions, mortgage rates have fallen an average of 1.8 percentage points from the peak seen during the recession to the trough. And in many cases, they continued to fall after the fact as it takes some time to turn things around even when the recession is technically over.”

In 2023, market experts say mortgage rates will likely stabilize below the peak we saw last year. That’s because mortgage rates tend to respond to inflation. And early signs show inflation is starting to cool. If inflation continues to ease, rates may fall a bit more, but the days of 3% are likely behind us.

The big takeaway is you don’t need to fear the word recession when it comes to housing. In fact, experts say a recession would be mild and housing would play a key role in a quick economic rebound. As the 2022 CEO Outlook from KPMG, says:

“Global CEOs see a ‘mild and short’ recession, yet optimistic about global economy over 3-year horizon . . .

More than 8 out of 10 anticipate a recession over the next 12 months, with more than half expecting it to be mild and short.”

Bottom Line

While history doesn’t always repeat itself, we can learn from the past. According to historical data, in most recessions, home values have appreciated and mortgage rates have declined.

If you’re thinking about buying or selling a home this year, let’s connect so you have expert advice on what’s happening in the housing market and what that means for your homeownership goals.

Key Factors Affecting Home Affordability Today

Key Factors Affecting Home Affordability Today

Every time there’s a news segment about the housing market, we hear about the affordability challenges buyers are facing today. Those headlines are focused on how much mortgage rates have climbed this year. And while it’s true rates have risen dramatically, it’s important to remember they aren’t the only factor in the affordability equation.

Here are three measures used to establish home affordability: home prices, mortgage rates, and wages. Let’s look closely at each one.

1. Mortgage Rates

This is the factor most people are focused on when they talk about homebuying conditions today. So far, current rates are almost four full percentage points higher than they were at the beginning of the year. As Len Kiefer, Deputy Chief Economist at Freddie Mac, explains:

“U.S. 30-year fixed mortgage rates have increased 3.83 percentage points since the end of last year. That’s the biggest year-to-date increase in rates in over 50 years.”

That increase in mortgage rates is impacting how much it costs to finance a home purchase, creating a challenge for many buyers that’s pricing some out of the market. While the current global uncertainty makes it difficult to project where mortgage rates will go in the future, experts do say that rates will likely remain high as long as inflation does.

2. Home Prices

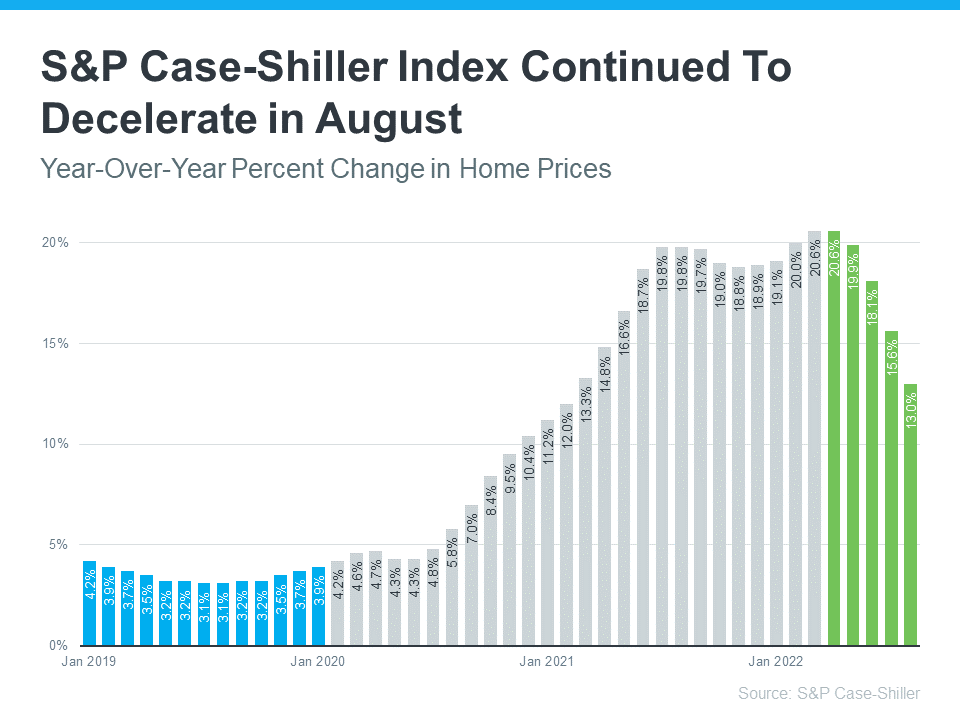

The second factor at play is home prices. Home prices have made headlines over the past few years because they skyrocketed during the pandemic. Now, the most recent Home Price Index from S&P Case-Shiller shows home values continued to decelerate for a fifth consecutive month (shown in green in the graph below):

This deceleration is happening because higher mortgage rates are moderating demand, and as a result, easing the buyer competition and bidding wars that previously drove prices up.

What’s worth noting though, is how much higher home prices still are than they were before the pandemic (shown in blue in the graph above). Even now, we have a long way to go to get to more normal levels of home price appreciation, which is historically closer to 4%. When both mortgage rates and home prices are high, affordability and your purchasing power become a greater challenge.

But while prices are still elevated in many markets, some areas are seeing slight declines. It all depends on your local market. For insight into what’s happening in your area, reach out to a trusted real estate professional.

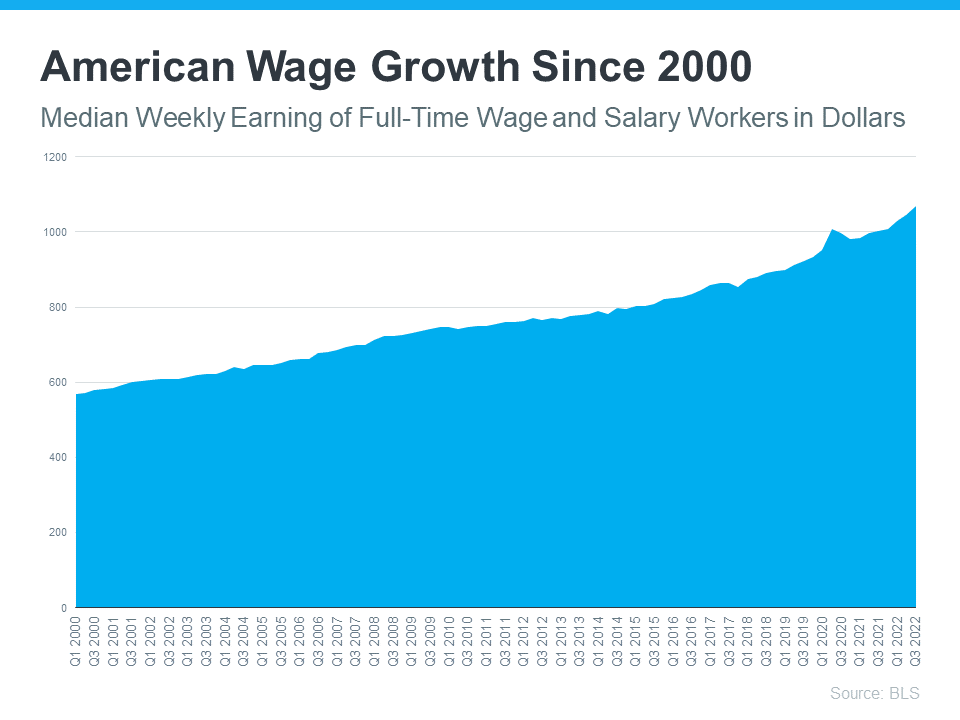

3. Wages

The one big, positive component in the affordability equation is the increase in American wages. The graph below uses data from the Bureau of Labor Statistics (BLS) to show how wages have grown over time. This year is no exception.

As the Bureau of Labor Statistics (BLS) reports:

“Median weekly earnings of the nation’s 120.2 million full-time wage and salary workers were $1,070 in the third quarter of 2022 (not seasonally adjusted), the U.S. Bureau of Labor Statistics reported…This was 6.9 percent higher than a year earlier…”

So, when you think about affordability, remember the full picture includes more than just mortgage rates. Home prices and wages need to be factored in as well. Because wages have been rising, they’re a big reason why serious buyers are still purchasing homes this year.

If you have questions or want to learn more, reach out to a trusted advisor who can explain how all of these variables work together and what’s happening in your area. As Leslie Rouda Smith, President of the National Association of Realtors (NAR), says:

“Buying or selling a home involves a series of requirements and variables, and it’s important to have someone in your corner from start to finish to make the process as smooth as possible… and objectivity to deliver trusted expertise to consumers in every U.S. ZIP code.”

Bottom Line

To learn more, let’s connect today and make sure you have a trusted lender so you’re able to make an informed decision if you’re planning to buy or sell a home right now.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link