East Texas: What’s Really Happening with Mortgage Rates?

Mortgage rates don’t move in a straight line. There are too many factors at play for that to happen. Instead, rates bounce around because they’re impacted by things like economic conditions, decisions from the Federal Reserve, and so much more. That means they might be up one day and down the next depending on what’s going on in the economy and the world as a whole.

Why Pre-Approval Is Even More Important This Year

On the road to becoming a homeowner? If so, you may have heard the term pre-approval get tossed around. Let’s break down what it is and why it’s important if you’re looking to buy a home in 2024.

What Pre-Approval Is

As part of the homebuying process, your lender will look at your finances to figure out what they’re willing to loan you. According to Investopedia, this includes things like your W-2, tax returns, credit score, bank statements, and more.

From there, they’ll give you a pre-approval letter to help you understand how much money you can borrow. Freddie Mac explains it like this:

“A pre-approval is an indication from your lender that they are willing to lend you a certain amount of money to buy your future home. . . . Keep in mind that the loan amount in the pre-approval letter is the lender’s maximum offer. Ultimately, you should only borrow an amount you are comfortable repaying.”

Now, that last piece is especially important. While home affordability is getting better, it’s still tight. So, getting a good idea of what you can borrow can help you really wrap your head around the financial side of things. It doesn’t mean you should borrow the full amount. It just tells you what you can borrow from that lender.

This sets you up to make an informed decision about your numbers. That way you’re able to tailor your home search to what you’re actually comfortable with budget-wise and can act fast when you find a home you love.

Why Pre-Approval Is So Important in 2024

If you want to buy a home this year, there’s another reason you’re going to want to be sure you’re working with a trusted lender to make this a priority.

While more homes are being listed for sale, the overall number of available homes is still below the norm. At the same time, the recent downward trend in mortgage rates compared to last year is bringing more buyers back into the market. That imbalance of more demand than supply creates a bit of a tug-of-war for you.

It means you’ll likely find you have more competition from other buyers as more and more people who were sitting on the sidelines when mortgage rates were higher decide to jump back in. But pre-approval can help with that too.

Pre-approval shows sellers you mean business because you’ve already undergone a credit and financial check. As Greg McBride, Chief Financial Analyst at Bankrate, says:

“Preapproval carries more weight because it means lenders have actually done more than a cursory review of your credit and your finances, but have instead reviewed your pay stubs, tax returns and bank statements. A preapproval means you’ve cleared the hurdles necessary to be approved for a mortgage up to a certain dollar amount.”

Sellers love that because that makes it more likely the sale will move forward without unexpected delays or issues. And if you may be competing with another buyer to land your dream home, why wouldn’t you do this to help stack the deck in your favor?

Bottom Line

If you’re looking to buy a home in 2024, know that getting pre-approved is going to be a key piece of the puzzle. With lower mortgage rates bringing more buyers back into the market, this can help you make a strong offer that stands out from the crowd.

Thinking About Buying a Home?

If you’re thinking of buying a home this year, you’re probably paying closer attention than normal to the housing market. And you’re getting your information from a variety of channels: the news, social media, your real estate agent, conversations with friends and loved ones, the list goes on and on. Most likely, home prices and mortgage rates are coming up a lot.

Here are the top two questions you need to ask yourself as you make your decision, including the data that helps cut through the noise.

1. Where Do I Think Home Prices Are Heading?

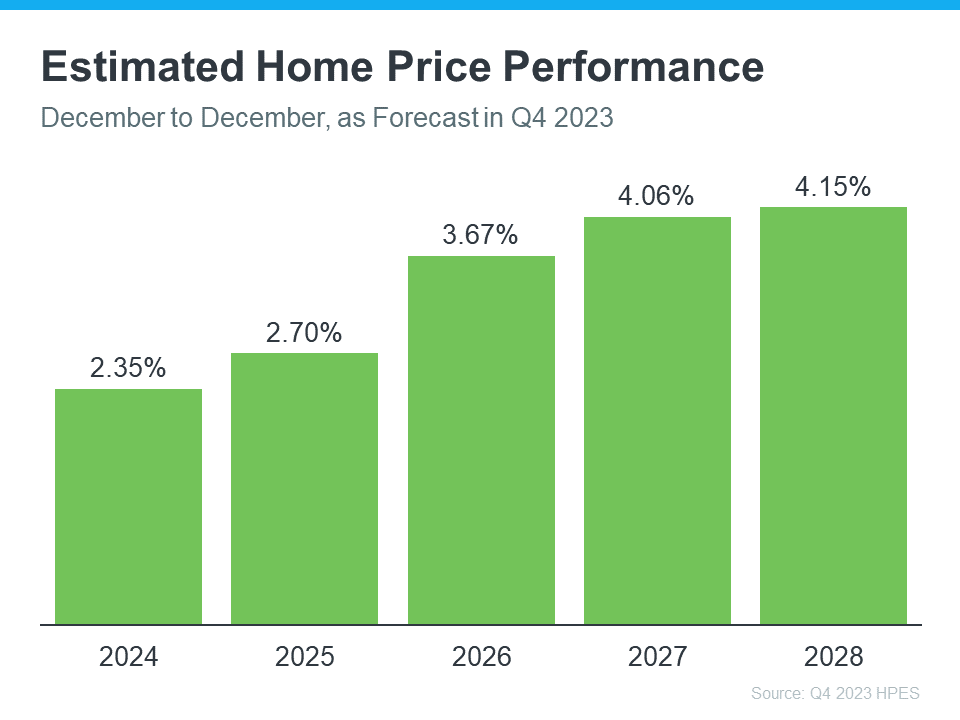

One reliable place you can turn to for information on home price forecasts is the Home Price Expectations Survey from Fannie Mae – a survey of over one hundred economists, real estate experts, and investment and market strategists.

According to the most recent release, the experts are projecting home prices will continue to rise at least through 2028 (see the graph below):

So, why does this matter to you? While the percent of appreciation may not be as high as it was in recent years, what’s important to focus on is that this survey says we’ll see prices rise, not fall, for at least the next 5 years.

And home prices rising, even at a more moderate pace, is good news not just for the market, but for you too. It means, by buying now, your home will likely grow in value, and you should gain home equity in the years ahead. But, if you wait, based on these forecasts, the home will only cost you more later on.

2. Where Do I Think Mortgage Rates Are Heading?

Over the past year, mortgage rates spiked up in response to economic uncertainty, inflation, and more. But there’s an encouraging sign for the market and mortgage rates. Inflation is moderating, and here’s why this is such a big deal if you’re looking to buy a home.

When inflation cools, mortgage rates generally fall in response. That’s exactly what we’ve seen in recent weeks. And, now that the Federal Reserve has signaled they’re pausing their Federal Funds Rate increases and may even cut rates in 2024, experts are even more confident we’ll see mortgage rates come down.

Danielle Hale, Chief Economist at Realtor.com, explains:

“. . . mortgage rates will continue to ease in 2024 as inflation improves and Fed rate cuts get closer. . . . a key factor in starting to provide affordability relief to homebuyers.”

As an article from the National Association of Realtors (NAR) says:

“Mortgage rates likely have peaked and are now falling from their recent high of nearly 8%. . . . This likely will improve housing affordability and entice more home buyers to return to the market . . .”

No one can say with absolute certainty where mortgage rates will go from here. But the recent decline and the latest decision from the Federal Reserve to stop their rate increases, signals there’s hope on the horizon. While we may see some volatility here and there, affordability should improve as rates continue to ease.

Bottom Line

If you’re thinking about buying a home, you need to know what’s expected with home prices and mortgage rates. While no one can say for certain where they’ll go, making sure you have the latest information can help you make an informed decision. Let’s connect so you can stay up to date on what’s happening and why this is such good news for you.

Facts About Closing Costs

If you’re thinking about buying a home, be sure to plan for closing costs.

Closing costs are typically 2% to 5% of the total purchase price of a home, and they can include things like government recording costs, appraisal fees, and more.

Let’s connect so I can answer your questions about the homebuying process.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link